Let’s be honest: real estate in 2023 was a bit of a rollercoaster. Between the Bank of Canada (BoC) rate hikes, historically low housing stock, and stubbornly high prices, many people – most notably first-time home buyers – found their dreams of homeownership to be out of reach. But what is the outlook for 2024 looking like? And more importantly, will we see a balance restored between interest rates, inventory, and pricing? Well, today, we’re exploring what homeownership looks like in the GTA, including a 2023 real estate review, as well as what to expect in the coming year.

2023’s Fluctuating Landscape

In an effort to control soaring inflation (which reached a record high of 8.1% in June 2022), the BoC hiked key interest rates 10 times between March 2022 and July 2023. This rapid increase in policy rate from 0.25% to 5.00% marked a 22-year high and meant that many prospective homeowners were subsequently unable to secure and support a mortgage at such high rates.

At the same time, inflation coupled with supply chain delays (thanks to COVID-19) resulted in Toronto construction projects experiencing a 40.5% increase in building costs from January 2020 to August 2023. As a result, construction costs for single-family and multi-family homes have climbed 51% since the beginning of 2020, affecting both the housing and rental markets.

But how does a lack of new housing inventory affect the rental market? With fewer places to live and more people to house than ever (Canada’s population grew by 3.2% over the past 12 months, driven primarily by international migration), landlords have been increasing their rent periodically to reflect the growing demand. For example, the average rent for an apartment in Toronto increased by 2.1% YoY from December 2022 to December 2023. Although great for landlords, this situation makes it increasingly difficult for prospective buyers to break out of the rental cycle and into the housing market.

So, you’re probably wondering, ‘What’s the good news?’ The good news is that fixed mortgage rates in Canada are falling, and many experts predict that the BoC will likely begin cutting rates again in 2024. However, while some economists predicted rates coming down as early as February, new information about core inflation could push this back. In January 2024, core inflation rose at a faster pace than expected, further highlighting the ‘challenging final stretch’ of the BoC’s campaign to control inflation and causing some experts to push back their bets on the BoC cutting rates to between April and June. Nonetheless, BoC Governor Tiff Macklem has stated that they will likely begin cutting rates again in 2024, which is a welcome reprieve for prospective buyers who have been sidelined due to these hikes.

GTA Stats (and Beyond)

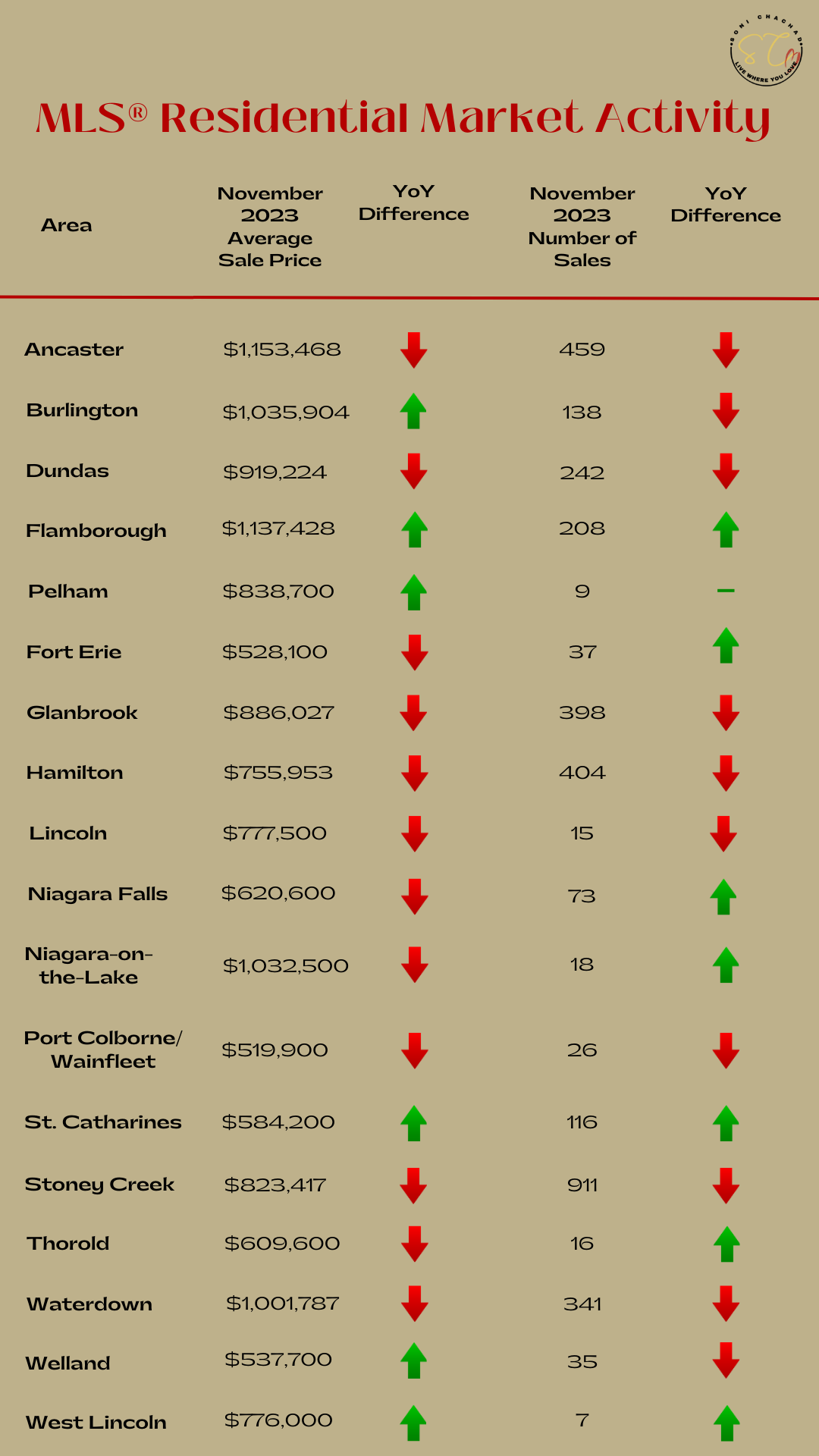

Now that we’ve talked about rate hikes and inventory let’s look at some statistics from the GTA for 2023. According to WOWA, there were 65,982 homes sold in the GTA in 2023 (the slowest year since 2000 when 58,343 homes were sold), with an average home sold price of $1,126,604 and a median price of $970,000. In addition, it took 28 days on average for a property to be sold in 2023, while the average listing day on the market was 19 days. Here’s a detailed breakdown of residential market activities for communities throughout the GTA.

Interestingly, when we zoom out from the GTA market and look Canada-wide, an intriguing statistic emerges – Canada-wide home sales grew in December despite price declines. This could potentially be a result of some sellers accepting lower prices (after realizing they would not achieve the higher prices seen in 2023), or it could indicate a shift in the market (although only time will tell). But on a more positive note, a Royal LePage 2024 market survey predicts that home prices across Canada will return to pandemic-level peaks in 2024, with home prices in Canada forecasted to rise by 3.3% in Q1 2024. More specifically, single-family home prices are projected to rise by 6% in Q4 2024 to reach $879,164, while condominium prices are expected to increase by 5% to $616,140.

Moving Into 2024

So, what does this all mean for people looking to make a real estate transaction in 2024? To put it bluntly, this could be the year you become a homeowner! Although lack of inventory will continue to be an ongoing issue (especially since many builders are trying to wait until interest rates come back down), the anticipation of interest rate cuts has experts speculating that home prices will rise again and reach pandemic levels by year-end. At this point, it’s almost unanimous among market experts that the BoC’s rate hiking cycle is over, but many Canadians are still left wondering when rates will go down and by how much. Though no one can say for sure exactly when the rates will be going down, economists predict that we can expect a decline of 1-2% in the key interest rate over the year. With this outlook in mind, sidelined buyers and investors will return to the market and resume activity, which we already see happening in the stock markets. Ultimately, with these market components stabilizing, real estate activity is already beginning to pick up, and we expect that 2024 will shape up to be a fantastic year in real estate.

If you’d like further information on market trends in your area or if you’re looking to get your next real estate transaction started, feel free to check out my exclusive listing and please do not hesitate to reach out to me directly!